CARES Act: Here’s What Restaurant Owners Need to Know19 min read

As of April 2020, three percent of restaurants in the U.S. have shut their doors. According to projections, that number could spike to 11% by the end of May. It’s our goal to make sure that you don’t become one of them. First, we’ll cover the CARES Act so you can get a clear idea of the funding options available to you. Then we shift gears into money saving mode, providing you with concrete, actionable strategies you can employ to make your CARES Act money go as far as possible.

Let’s drive right in.

What Is the CARES Act?

In March 2020, President Trump signed the CARES Act. The Coronavirus Aid, Relief & Economic Security Act is the biggest economic relief initiative in U.S. history. In total, $2.2-trillion dollars have been earmarked for the relief package. Here’s what the package includes:

$300-billion in relief payments to individuals.

This is going out to folks who earn less than $99,000 per year. The maximum possible payment for a family of four is $3,400.

$350-billion in loans for small businesses.

These loans include forgiveness provisions.

$250-billion in extra unemployment insurance.

This funding is meant to bolster state unemployment programs.

The CARES Act provides economic assistance to individuals and businesses affected by the COVID-19 pandemic to ensure that our economy remains strong. Or, at the very least, that it doesn’t collapse before researchers produce a vaccine. The legislation was passed with overwhelming bipartisan support. This may seem a minor detail, but the fact that it has bipartisan support indicates that American lawmakers of all stripes understand the potential severity of the situation we’re in.

Over 300,000 restaurant owners joined forces with the National Restaurant Association to ensure that the restaurant industry—one of the hardest hit—got fair representation in the relief package. One way that the CARES Act supports restaurant owners is the Paycheck Protection Program. This program aims to provide you with the resources you need to rehire staff.

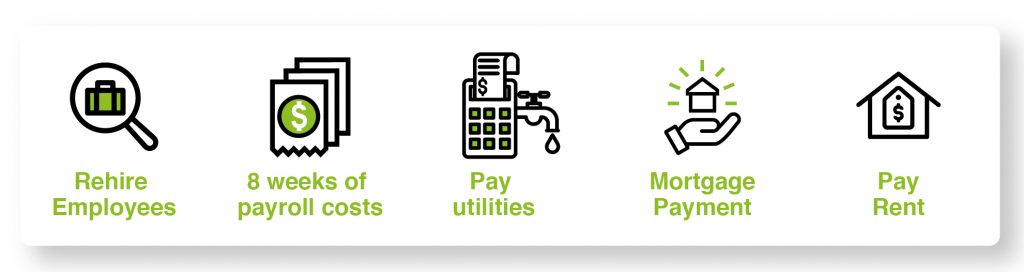

Naturally, rehiring staff may not be viable as long as you’re restricted to delivery or curb side. However, another goal of the program is to prevent further job loss. The program covers up to eight weeks of payroll costs. But you can also use some of the funds to manage overhead, pay utilities or make rent or mortgage payments. The program is managed by the Small Business Administration and is supported by the Department of the Treasury.

You can see an overview of the program here.

If you plan to take advantage of the program, see this resource after reading the rest of this post.

What You Need to Know about Loans & Grants

Any business with fewer than 500 employees can qualify for forgivable loans and grants provided by the CARES Act. $10-billion of the CARES Act fund is going toward emergency grants. These grants are intended to cover ongoing—and urgent—operating costs. Note that grants are capped at $10,000 per business. The upshot, of course, is that no one expects you to repay.

As noted, an additional $350-billion was earmarked for forgivable loans. These loans are capped at $10-million per business or 2.5 months of payroll, whichever is less. A forgivable loan, or a soft second loan, is a loan that allows a lender to forgive a portion of the balance if certain conditions are met. In the context of the COVID-19 crisis, this would likely mean proving considerable hardship that makes you unable to pay all of the loan back.

Note that it’s still possible to default on a forgivable loan. If you do, you’ll ding your business credit. Damage to your credit score begins as soon as the creditor reports the first missed payment. Keep this in mind when applying. Ask for an amount you’re sure you can repay once business returns to normal.

Congress has ordered the relaxation of many of the tests for eligibility. While this doesn’t guarantee you a loan, it does mean that if you can demonstrate historical positive cash flow, you stand a good chance. Additionally, because so much money has been allocated to the Paycheck Protection Program, restaurants with large employee counts can qualify.

The Small Business Administration is providing several other loan and debt forgiveness options. You can use this tool from Quick Base to see if you qualify for any of these loan types.

If you already have a loan through the SBA, you may be eligible for aid that will cover six months of payments.

Taxes

In a further effort to support the restaurant industry, the U.S. government is allowing small business owners to defer their social security taxes for a time. As long as you pay half by 2021, you’re in good shape. But you’ll need to pay the second half by 2022. If you try to retain as many staff members as possible, you may qualify for the Employee Retention Tax Credit. This will earn you a refundable tax credit for 50 percent of wages you paid during the COVID-19 crisis.

The legislation also calls for the IRS to finally fix the dreaded Qualified Improvement Property Tax issue. For years, restaurant owners were only allowed to depreciate renovations over 39 years. Now, you can do it over 15. This applies to renovations you did as far back as 2018.

What About My Employees?

As of April 2020, over 6-million Americans have filed for unemployment. Many of them were in the restaurant industry. To address this, the CARES Act will help individuals get through these trying times by providing expanded unemployment benefits. The legislation also authorizes the government to send out relief checks. Some Americans have already received $1,200 stimulus checks. This will go some way to revitalizing the economy.

Individuals who earn less than $75,000 per year will receive a check or direct deposit. What’s more, parents below the $75,000 mark will receive $500 per dependent given that certain other criteria are met. Folks earning between $75,001- and $99,000, meanwhile, will receive a smaller check. Individuals above the $99,000 mark will not receive a check at all.

People earning unemployment benefits will continue to receive the same amount from their state. However, the government is contributing $600 per month to each individual. The bill also allows for 13 additional weeks of unemployment insurance. So if you had to let someone go early on, take a second to enjoy a little sigh of relief. They can file for an extension.

According to the IRS, anyone who has already filed their taxes will receive their return in the amount they’re expecting. Stimulus checks will not affect this. For those who haven’t yet filed, the IRS is extending the deadline to July 15th.

On the health insurance front, anyone already on a private insurance plan is in good shape. The CARES Act requires providers to cover all COVID-19 treatments and to offer free coronavirus testing. Folks who are currently uninsured should check with their state. 11 states so far have announced special COVID-19 enrollment periods.

Other Ways You Can Benefit

The CARES Act features several other ways to support your organization, though these are more indirect.

#1 Public Health

Community health centers nationwide are set to receive $1.32-billion. These centers provide care to 28-million Americans who have no or insufficient insurance. Your lower income employees will have additional options for care, keeping them healthy and safe.

The legislation sets aside a further $20-billion for VA hospitals and care. Any veterans on your staff are sure to benefit.

#2 Education

Your younger staff members will have one less thing to worry about. All federal student loans are interest-free until September 30th, and many can defer payments. Plus, if you have employees who have had to drop out of school because of the COVID-19 pandemic, the time off won’t be counted against their lifetime limit on Pell grant eligibility or student loans.

#3 Food

$8.8-billion has been set aside for feeding children in need. In addition, SNAP—Supplemental Nutrition Assistance Program—has been infused with $15.5-billion to help cope with a flood of new applicants. The following geographical areas will receive additional funding:

- American Indian reservations

- Northern Mariana Islands

- American Samoa

- Puerto Rico

Finally, food banks will collectively receive $450-million.

Potential Issues

While all of this sounds great, some business owners have already run into problems. According to Angela Salamanca, owner of the Raleigh, NC, restaurant Centro, she tried every day for a week to get into her state’s unemployment page. But the system was slow, laggy or locked up each time she tried. She wasn’t able to approve benefits for employees she had been forced to lay off. Like many states, North Carolina has received a flood of claims, clogging taxing the system.

According to some experts, such as Andrew Rigie, Executive Director of the New York City Hospitality Alliance, the CARES Act is a good start. But, says, Rigie, it’s not enough. Since restaurants serve as hubs of social activity, they may be among the last business types to reopen. Even when they do open, there may be restrictions in place for some time. This would be in an effort to further ‘flatten the curve’ while vaccines are made available.

Rigie further points out that in order to qualify for some Payroll Protection Program loans, an employer needs to have roughly the same number of employees now that they did before the COVID-19 crisis struck. This provision may unfairly affect restaurant owners who were forced to close their doors. To qualify for the best loans, they must rehire staff by the end of June, and they must provide documentation proving they did so.

But how can you rehire staff if you aren’t sure you’ll have sufficient cash flow?

This poses a significant hurdle to business owners who can’t easily pivot to delivery or carry out, and the solution is not readily apparent. Even those who can make the transition have no way of knowing if they can reach cash flow levels comparable with where they were at before.

Make Your Money Go Further

For this reason alone, it’s imperative that you make the most of any CARES ACT relief money you get. The rest of this guide is dedicated to helping you do that. Read on.

#1 Assess the Damage

You need to pull the band aid off and take a look. Many entrepreneurs have gone out of business because they were unwilling to assess the damage while they could have done something about it. Don’t let this be you. Knowledge, after all, is power. Download the data provided by your POS and take a dispassionate look.

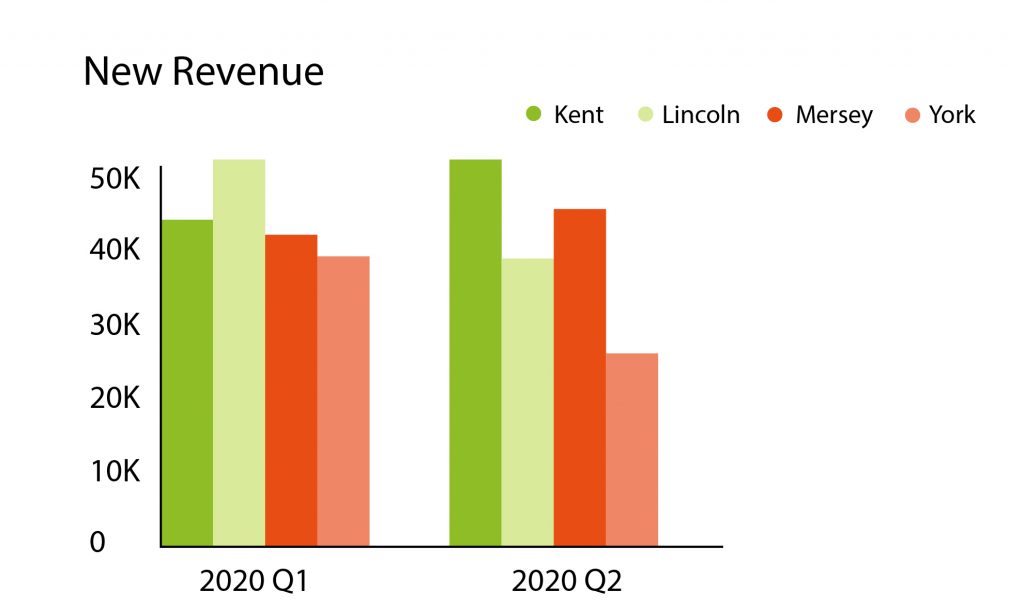

How much money is coming in right now? How does that compare to a month ago? Three months? How does this week compare to a typical week? What is the percent deviation?

On average, how do your sales compare to what they were three months ago?

The above illustration is an oversimplification, of course. But it demonstrates the point. If your revenue is in free fall, and your last few weeks are trending below the moving average of your last three months, you’re in trouble.

It’s better to face reality than to hope things will somehow turn around.

Right now, every dollar counts. So part of your assessment should be your inventory. Check your freezers and dry storage to see how much stock you have on hand. Calculate the value of everything you have in stores right now.

Then, consider using what you have on hand right now as the basis for your reduced menu. Plus, if you buy any ingredients that are only used in one or two dishes, stop ordering them. This way, you’ll save money on unnecessary menu items and you’ll also have predictability in your inventory costs until things return to normal.

#2 Try to Lower Your Rent or Get More Time to Pay

If you’ve faced mandated shut down or restricted hours, you’re probably burning through your savings. No surprise there. You may even be struggling to make this month’s rent. The good news is that most landlords want you to survive, and more than that, prosper. As a restaurant, you’re a good tenant. You have—under normal circumstances—a high likelihood of being able to pay your rent.

Your landlord knows that if the economy worsens, it may be difficult to replace you. They would be facing months of lost rent revenue then too.

So take a breath. Relax. Your landlord’s goal is to collect regular rent payments. Your goal is to make those payments. You’re not enemies. However, COVID-19 does not automatically release you from your rent obligation. While some leases make room for so-called acts of god, or force majeure clauses, these are hard to enforce. A force majeure clause only impacts a landlord’s ability to claim that you defaulted on the lease.

Note: a force majeure may free you from the obligation to make repairs as you normally would, but it probably doesn’t free you from your rent obligation.

Then what should you do?

Communicate.

If you have a good working relationship with your landlord, try to establish a dialog now. Reach out to them ASAP and explain, in simple, clear terms, what the situation is. If you’re going to be late with the rent, let them know now. Don’t wait. If you don’t have a good relationship, then this may need to take the form of your attorney reaching to their attorney. In either case, here’s what you need to do:

Let your landlord know what you’ve done or had to do in response to the COVID-19 situation.

This includes any pivots you’ve had to make, such as switching to delivery only. This also includes any associated costs you incurred. Naturally, if you’ve had to shut down entirely, lead with that.

Make the case.

Make the point, tactfully, that this is an unprecedented situation and that no amount of preparation could have completely insulated you from it. State that you’re looking forward to working with them to find a mutually beneficial solution.

Ask for what you need.

Don’t be coy. If you need a temporary rent reduction, you need to ask for one. Your landlord is not likely to offer it on their own. When you hear back, listen carefully for concrete confirmation that they understand your situation. You don’t want to hear empty platitudes.

When you reach out again, you need to:

Get confirmation.

The best case scenario is a written statement acknowledging that they are willing to work with you. This may take the form of rent reduction, abatement, or deferment.

Get a lease amendment.

Make sure your landlord creates an adjusted rent agreement that reflects the changes. Get this in writing. Don’t stake the future of your business on a verbal agreement.

Get assurances.

You need written assurance that your landlord won’t issue default notices while things are still being hammered out.

All of this can be a big ask. Put yourself in your landlord’s shoes. Understand that what you’re asking for amounts to revenue loss for them. Be respectful, tactful, calm, and patient at all times.

Important Note

If your landlord isn’t willing to work with you, you may be headed for trouble. There is a specific ‘gotcha’ they may be waiting to use on you. But we’ll let you in on it so you can avoid it.

At no point should you say something like, “I’m not going to pay rent.” Many commercial leases contain verbiage that allows the landlord to claim that you’ve defaulted if you make statements like that. Never send anything of the sort in written form, either. Always phrase things in terms of I’m trying my best, but… Never say anything that could lead the landlord to believe you intend to flat out ignore your rent obligation.

As always, if in doubt, consult an attorney.

If you’ve already received a default notice because of nonpayment of rent, consult an attorney immediately. Your attorney will review your lease. They’ll find out how many days you have to resolve the default, and they’ll see if there’s any wriggle room. Your attorney will know how to negotiate abatement or deferral. More importantly, if all else fails, your attorney will know how to file an injunction. An injunction is by no means a get out of rent free card. But if nothing else, it can buy you some time.

Finally, check with your city and state. Some cities have tenant protections in place for circumstances like this. You might be covered. Some places, like New York City, have a hold on evictions while the COVID-19 pandemic is ongoing, for instance.

#3 Negotiate with Suppliers

Customers might be the life blood of your business. But your customers consume the ingredients provided by your suppliers. An important thing to keep in mind when dealing with suppliers is that they come in a variety of sizes.

There’s a misconception that a supplier must be a huge multi-national conglomerate. Some are. But some are mom and pop operations, specializing in providing a few high-quality ingredients. A huge supplier will be able to work with you. A mom and pop operation? Possibly not.

Suppliers are feeling the bite too. So when looking for wriggle room, do your homework. Rank your suppliers by size, or revenue if possible, and start from biggest to smallest when looking to negotiate.

Next, look for even more ingredients you can cut. You’ve probably pared your menu down already. Do you have any items that only require a few ingredients from a given supplier? That’s a good reason to drop that supplier for now. Without being aggressive about it, you can make this point to them. The math is quite simple. If it’s costing you money to order those ingredients, then you shouldn’t do it—unless they can give you a discount or work with you in some other way.

All suppliers are aware of the current situation and the stress their customers are under. If you’re worried about being the first customer to ask for a discount, get over it. They’ve heard it all before. The worst that can happen is that they’ll say no. Only pay the list price if you have to.

Every small price break adds up.

When negotiating with suppliers, be sure to phrase things in terms of benefits to them. Don’t talk about yourself. Don’t talk about how the discount will save you money. Talk about how the discount will allow you to buy more from them.

They’re not doing you a favor. Instead, by giving you a discount, they’re simply acting in their own best interest.

At the end of the day, you’re partners. You need to be willing to meet each other halfway. But if you never ask for a discount, the answer is definitely no.

#4 Buy Second Hand

Now is not the time to buy anything new if you can help it. Instead, shop at retailers who offer items second hand. Sometimes, you can find used kitchen items at deep discounts. No, they won’t last as long as new equipment would. But you can worry about that when you’re not in crisis mode.

You can buy stoves, grills, and flat tops second hand with little worry. New items would look better, sure. But as long as you’re buying from a reputable vendor, secondhand items like these will perform nearly as well as their brand new counterparts do.

Besides, it’s not like your customers will see your kitchen right now, right? If you do take staff or kitchen shots for social media, you can be selective with your camera angles.

To find high-quality used goods, your best bet is resellers who specialize in restaurant equipment. You can also peruse Craigslist and eBay. But keep the old adage in mind: buyer beware. Read the listings carefully and watch for phrases like “as is.” Of course, there’s nothing wrong with buying an item as is if you know what you’re getting into.

#5 Communicate

We covered this in more detail in our last post, so make sure to check it out for more. But the bottom line is, now more than ever, you need to communicate with your customers. Let them know what steps you’re taking to safeguard their safety. Customers want to know that delivery is a safe option. If they have any doubts, they’ll just cook for themselves.

One thing you can do to communicate the effort you’re taking is to send out pictures of your staff hard at work. Show off your gleaming kitchen, too. You could even share pictures of your staff enjoying your delicious food in your break room. This can have a powerful subliminal effect on consumers. After all, they’re stuck at home eating their own cooking day in and day out.

Above all, make sure your customers know what you’re offering. Are you offering call-ahead ordering? Curbside? Delivery? Make sure to post about these options on social media. Update your Google My Places listing, too.

Make it easy for customers to take action.

Always, always keep your messaging positive. Everyone is stressed right now. Don’t add to that by talking about your woes. Keep the message upbeat.

#6 Update Your Website

If you’re having to swerve to delivery only, don’t neglect your website. You may need to sink some money into it. Make sure it’s mobile friendly and that it accurately reflects your current offerings.

Confused customers equal lost revenue.

If a customer visits your page but can’t immediately access your new delivery menu, they’ll leave. If your site doesn’t scale with their mobile device, that’s a problem. If your site is slow or unresponsive, that’s going to cost you. Make any changes you need to make, because failing to plug these holes is akin to intentionally taking on water.

If you’re offering delivery only, make that clear with a minimum of clicks. You may even want to put it on your homepage for now. A big, CALL TO ORDER! graphic may be garish under normal circumstances, but these aren’t normal circumstances. Make sure your customers know how to do business with you.

Did you find this post helpful? We hope so! If you did, could you consider giving us a share? Someone else might benefit too! Thanks!