Differences Between Card Present Transactions and Card Not Present Transactions2 min read

Industry experts say that the way payments are processed are currently changing (and will continue to,) over the next few years more than they ever have, since the implementation of the credit card. What we are now looking at is the high cost rate difference between card present (CP) and card not present (CNP) transactions. The difference on some interchange tables can be more than 100 basis points, which is a full percentage and more of cost. There is usually an up-charge associated with transactions involving the manual entry of card data on a keyboard. And it’s typically something like 3.50%, which is a 75 basis point variant from typical charges.

Reducing the Overall Cost Percentage

In prioritizing the typical needs of merchants, the costs associated with payment processing is neither at the top, nor the bottom of the list. Certainly the cost of sales transactions is reflected in the cost of sold items, however when sales are increased sufficiently, the impact is just a few cents on a $100 sale.

Prioritizing Forms of Loss Management

Now, for e-commerce retailers, those few cents can end up adding up rather rapidly, but in the area of company loss, they come nowhere close to the disastrous effects of losses from merchandise fraud. E-tailers are not covered for fraud losses, as the card is never presented, which has long been regarded as the same thing as the card holder being present for the sale. And in the bigger picture, effective management of fraud levels should matter much more than the variation of cost between CP and CNP.

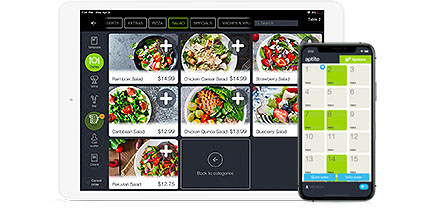

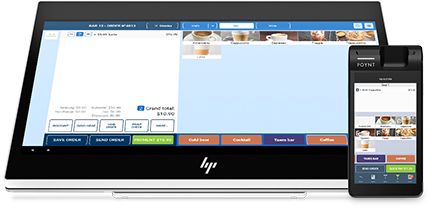

Seeing as how increased sales is the pinnacle of ambition of every merchant in business today, what is most valued across the board is any means by which sales can be effectively increased. And so, while understanding that fraud loss management is a prevalent aim of business, anything that can be implemented to increase sales is in hot demand. One of the leading boons to increased sales has been the rise of mobile apps, as well as their utilization of on-file card payments, even though such payments are charged back to merchants as card not present payment rates. And even though they cost significantly more, increasing numbers of merchants are beyond willing to process such payments, especially because all of these apps increase their sales enough to compensate for the loss. It’s been proven that when mobile apps work well, they actually engender warm feelings and even passion from customers. What form of advertising could do more?